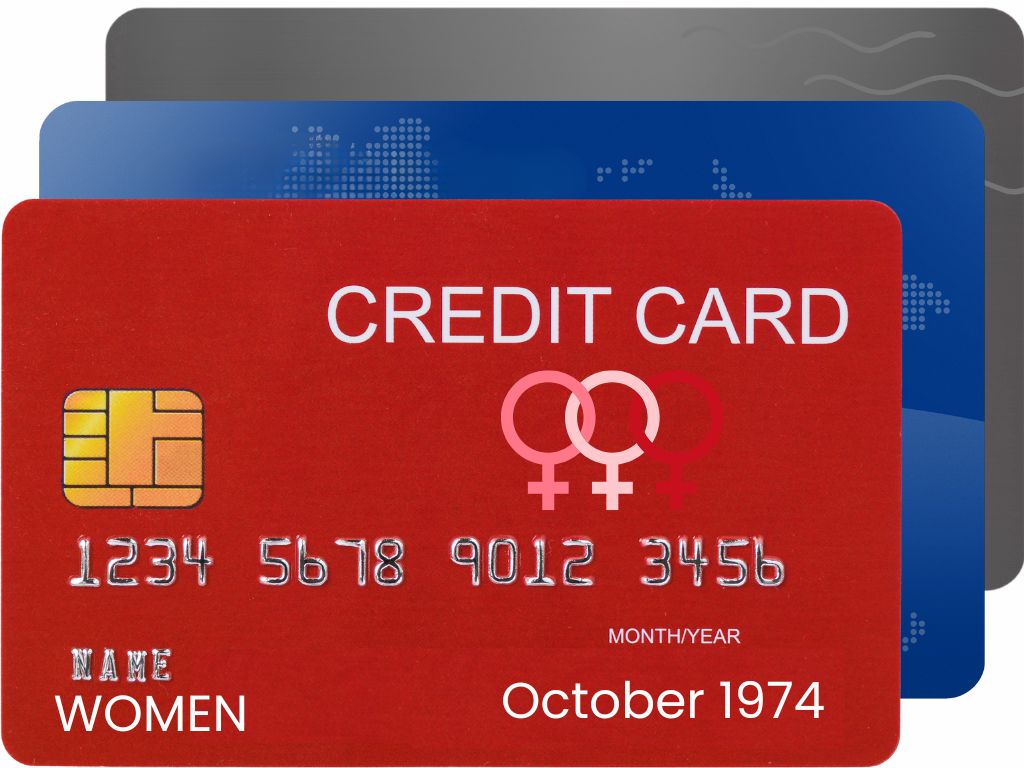

It’s only been half a century since women could get credit in their own name. We’ve come a long way from, “Pretty please, can I buy a blender?”—but we still don’t get all the credit we deserve.

The fight for financial equality has entered midlife. It was just 51 years ago, on October 28, 1974, that women earned the right to a credit card in their own name. Before that? If you were married, you could only get a card in your husband’s name. And if you were single? Good luck. Unless you got your dad to co-sign for you.

So that little piece of plastic in your purse? It wasn’t about points, perks, or miles. It was about access. Freedom. Financial independence. Not having to rely on a man or ask, “Can I please have a credit card?” Imagine asking your husband for permission to buy a blender. That wasn’t a joke, but women were the punchline.

The Equal Credit Opportunity Act (ECOA) ushered in a new era by prohibiting lenders from discriminating because of marital status or sex. Before that, women were routinely denied credit cards, regardless of their income or work history. They could make the payments, but couldn’t access the credit—at least not without a man.

Your Application Has Been Denied

Today, you can walk into any store and pretty easily get a store credit card in your name. But that wasn’t always the case.

Over 50 years ago, Laura*, age 74, applied for a department store credit card. Her simple request? Denied. Because they mandated that it be in her husband’s name. Despite the fact that she was the breadwinner while her husband was a student. Furious, she vowed never to shop there again, taking some of her financial power back.

Consider the mental calculus required to deny credit to a woman who’s holding the purse strings. Back then, lenders weren’t assessing credit risk, they were assessing gender risk.

You make more money than your husband? Good for you, but not good enough. What if you were a single woman or divorced? No man, no credit. Nancy Kalef, age 92, found that out the hard way.

In 1973, she did something that wasn’t as common then. She divorced her emotionally abusive husband. Reclaimed her independence. Her safety and sense of self. Only to be reminded of the barriers in place for women who were on their own. She applied for a credit card.

“I got declined and I saw red. I was very angry. How dare they decline me? They said, ‘You have to have your husband’s name on the account.’ And I didn’t have a husband anymore,” said Kalef.

She turned her rage into action. Kalef called the credit card issuer and explained that she was working. That she didn’t have a history of not paying her bills. After standing her ground and having them talk to the higher-ups, she was mailed a credit card in her own name. But with a low credit limit, a common practice at the time.

That’s what happens when the financial systems in place are built by and for men.

The Power In the Plastic

Having access to a credit card in your own name is a big deal. But here’s the irony: After 1974, the same institutions shunning women targeted them with patronizing pink designs and sky-high 27 percent APRs.

Despite this, credit cards can be a means to an end. They help build your credit score, which can unlock new opportunities and serve as a lifeline. Getting divorced? If you apply for an apartment or a mortgage, your credit score can determine your approval and interest rates. Need an auto loan? Same thing. Need to get out of a bad situation right now? You can use a credit card to book a hotel, a bus, or a train, and get out of dodge.

“Being able to get credit in your own name gives women the ability to build an independent financial life. Whether it’s starting a business, buying a home, or financing a car or an education, access to credit is often essential to economic mobility,” said credit expert Gerri Detweiler.

Before the ECOA, married women who had credit cards in their husband’s name only helped to build their spouse’s credit. Women were merely an accessory. Now? Women can build their own credit—and their financial futures.

Debt and the Double Standard

Whatever you spend on, people are likely to judge anyway. Where do you think the shopaholic trope came from? And while it’s always smart to pay off your balances in full, it’s not always possible. Many people are just trying to get by.

A recent survey from AARP showed that 47 percent of adults 50 years of age and older who are in credit card debt used credit cards to pay for basic living expenses. Why? Because they didn’t have enough money to cover them. Credit cards, as a tool, can help you bridge the gap between your income and expenses or navigate a tough transition. Debt doesn’t have to define you or your worth. You can take your power back by paying down the balance, so lenders aren’t profiting off of your pain.

You Deserve More Credit

Access to credit has been hard-won. We can get credit cards in our own name because the women before us fought for this very right. It feels good to be on this side of history. Half a century later, we have financial independence, but the fight isn’t over. We have the plastic, but not the parity.

Women 50+ are still seriously underserved (which is a polite word for ignored) by the credit and financial industry as a whole—despite women over 50 making up 27 percent of all consumer spending. Though the ECOA was a major win, progress hasn’t kept up in other areas. Women face lower lifetime earnings and a gender pay gap that tends to widen with age. So while we celebrate the victory, the fight to be seen and heard continues—and to get the credit that we deserve.

*The name has been changed for privacy.

******

FINANCIAL DISCLAIMER

The information provided on provokedmagazine.com/ is for general informational purposes only and does not constitute financial, legal, tax, or investment advice. SFD Media LLC and its contributors are not licensed financial advisors, investment advisors, brokers, accountants, or attorneys. You should consult with a qualified professional before making any financial decisions based on this content. While efforts are made to ensure the accuracy and timeliness of the information, SFD Media LLC makes no representations or warranties, express or implied, regarding its completeness, accuracy, or applicability to your individual circumstances. Reliance on any information from this site is solely at your own risk and discretion.

One Response

I really appreciate this article, Melanie. The ads and data you provided from when I was just a tot in the early 60s explains a lot about my mother’s view of herself, and me!